Expert opinion: cathode powders for Tesla's batteries would cost $50 per KWh at spot metal prices.

Summary

- Total Battery Consulting’s Dr. Menahem Anderman is highly regarded in the battery and EV industries and his Advanced Automotive Battery Conferences are pre-eminent industry events.

- In response to my recent article on the precursor metal values in Tesla’s cells, Dr. Anderman sent me his estimate of the price Panasonic pays for finished NCA cathode powders.

- I wrote back and asked Dr. Anderman to re-run his calculations using the same metal prices I used for my article.

- Since Dr. Anderman’s knowledge of the battery industry is deeper than mine and his analysis is more granular, I’m delighted to offer his cost estimate as more authoritative and accurate.

On Tuesday I published an article titled “Tesla, Artfully Dodging Discussions About Technology Metal Costs And Supply Chain Risks” that used lithium-ion battery cathode composition data from an MIT-Berkeley study and current spot market prices for precursor metals to calculate the value of precursor metals in the cathode powders for NCA batteries, the chemistry used by Tesla (TSLA) in its electric vehicles.

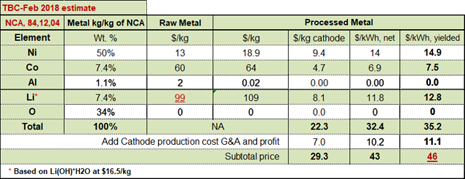

A few hours later I received an unexpected e-mail from Dr. Menahem Anderman of Total Battery Consulting that said:

“Hello John,

I just read your recent Tesla related article on Seeking Alpha.

You are generally on the money.

Here are my calculations for the Tesla-Panasonic Cathode.”

I was surprised and pleased because Dr. Anderman is well known and highly regarded in the battery and EV industries and I didn't know he followed my work. His company, Total Battery Consulting, serves an impressive client list and his Advanced Automotive Battery Conferences are pre-eminent industry events. Total Battery Consulting also publishes several multi-client research reports. Quite simply, his understanding of the industry and access to non-public information is extraordinary.

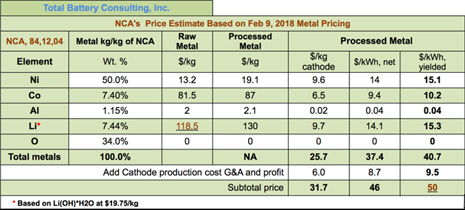

Since Dr. Anderman's cobalt and lithium prices were significantly lower than the spot prices I used for Tuesday's article, I asked if he'd be willing to re-run the table using my prices. I received this version by return email.

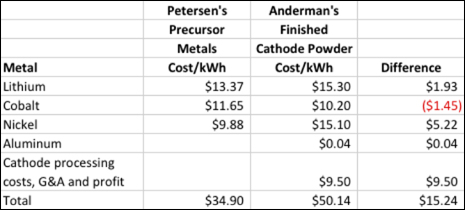

The differences between my rough calculations and Dr. Anderman’s more granular calculations are summarized in this table.

The differences between my calculations and Dr. Anderman's arise from the following factors:

- Dr. Anderman used a Tesla specific NCA chemistry (LiNi0.84Co0.12Al0.04O2) while the MIT-Berkeley team used a generic (LiNi0.8Co0.15Al0.05O2) chemistry that uses a little less nickel and a little more cobalt.

- Dr. Anderman's table reflects the cost of upgrading LME grade metals to battery grade precursors in column 4; and

- Dr. Anderman's table separately accounts for the cost of processing battery grade precursor metals into finished cathode powders.

In a subsequent email exchange, Dr. Anderman explained that assuming pack production volume of 200,000 units per year in 2020, he expects Tesla to have cell level costs of $122 per kWh and pack level costs of $157 per kWh.

Since readers frequently complain that my sources don’t know what’s going on behind closed doors at Tesla or Panasonic (OTCPK:PCRFF), I’ll simply offer this PR photo taken at Panasonic’s headquarters in March 2016. Dr. Anderman is the third man from the left. The man on Dr. Anderman’s right is Kenji Tamura, the head of Panasonic automotive battery business, and the man on his left is in charge of the Tesla account.

In connection with obtaining Dr. Anderman’s consent to publish his tables and PR photo in this article, I offered him a complimentary subscription to my new Battery, EV & Metals Forum and invited him to participate in discussions where his knowledge and expertise will be helpful. He accepted on the condition that the Forum stays neutral, rather than trying to support one side, and does not take too much time.

Investment conclusion

It’s becoming increasingly clear that Tesla’s guidance of sub-$100 cell costs is pure fantasy. That number might have made sense a couple years ago when precursor metal prices were lower. But it does not make sense today and it will not make sense in the future unless a natural resource fairy wearing a cobalt blue dress blesses our species with unlimited quantities of cheap technology metals.

At this point, I believe an unhedged long position in Tesla is the epitome of foolishness.

Readers who enjoy in-depth data-driven analysis should consider my Battery, EV & Metals Forum, a premium research service in the Seeking Alpha Marketplace for investment professionals who need first class due diligence, first-hand knowledge of cradle-to-grave nuance in the battery industry and a solid background in law, finance and market dynamics. I plan to launch the Forum later this week with significant price incentives for early subscribers.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Written by John L. Petersen